All Categories

Featured

Table of Contents

This is no matter of whether the insured individual passes away on the day the plan begins or the day prior to the plan finishes. A degree term life insurance coverage plan can suit a large range of conditions and needs.

Your life insurance policy policy can also create part of your estate, so might be based on Estate tax learnt more concerning life insurance policy and tax obligation - Level term life insurance. Let's consider some functions of Life insurance policy from Legal & General: Minimum age 18 Optimum age 77 (Life insurance policy), or 67 (with Vital Illness Cover)

The amount you pay stays the exact same, however the degree of cover decreases roughly in line with the way a repayment home mortgage lowers. Lowering life insurance coverage can assist your enjoyed ones stay in the household home and stay clear of any type of additional interruption if you were to pass away.

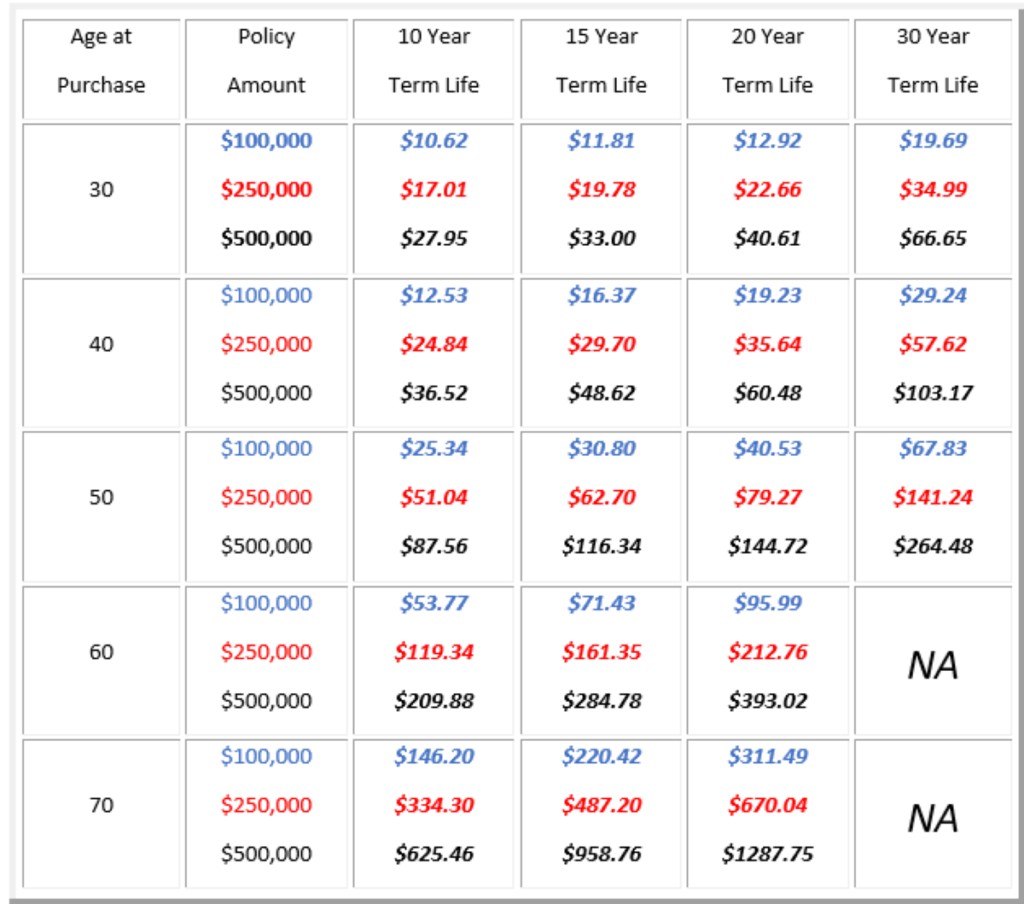

If you select level term life insurance coverage, you can budget plan for your premiums since they'll remain the exact same throughout your term. Plus, you'll recognize exactly how much of a survivor benefit your beneficiaries will receive if you pass away, as this quantity won't change either. The rates for level term life insurance policy will depend on a number of aspects, like your age, health and wellness standing, and the insurance provider you choose.

As soon as you go through the application and clinical exam, the life insurance policy company will assess your application. Upon approval, you can pay your first costs and authorize any relevant documents to ensure you're covered.

What is Level Premium Term Life Insurance Policies? Explained in Simple Terms?

You can choose a 10, 20, or 30 year term and take pleasure in the added tranquility of mind you should have. Working with a representative can help you discover a plan that functions ideal for your needs.

As you try to find means to secure your monetary future, you've likely found a variety of life insurance policy options. Picking the ideal insurance coverage is a huge decision. You intend to find something that will certainly help support your loved ones or the causes crucial to you if something happens to you.

Why You Should Consider Life Insurance

Several individuals favor term life insurance policy for its simpleness and cost-effectiveness. Term insurance coverage contracts are for a reasonably brief, specified time period yet have choices you can tailor to your requirements. Certain advantage options can make your costs change gradually. Level term insurance, nevertheless, is a kind of term life insurance policy that has regular settlements and a constant.

Level term life insurance policy is a part of It's called "level" since your premiums and the advantage to be paid to your loved ones remain the exact same throughout the agreement. You won't see any kind of changes in cost or be left asking yourself regarding its worth. Some contracts, such as yearly renewable term, may be structured with premiums that enhance with time as the insured ages.

They're determined at the beginning and stay the same. Having regular payments can help you far better plan and spending plan due to the fact that they'll never ever change. Repaired survivor benefit. This is also evaluated the start, so you can understand precisely what death advantage quantity your can expect when you pass away, as long as you're covered and up-to-date on costs.

This usually between 10 and three decades. You accept a fixed premium and survivor benefit throughout of the term. If you pass away while covered, your fatality advantage will be paid to loved ones (as long as your premiums are up to day). Your beneficiaries will recognize beforehand just how much they'll obtain, which can aid for intending functions and bring them some financial safety and security.

What is Level Premium Term Life Insurance and Why Choose It?

You may have the choice to for an additional term or, more probable, restore it year to year. If your agreement has a guaranteed renewability stipulation, you might not require to have a brand-new medical examination to keep your insurance coverage going. Your costs are likely to enhance because they'll be based on your age at renewal time.

With this option, you can that will last the rest of your life. In this case, once again, you may not require to have any kind of new medical tests, yet premiums likely will climb due to your age and brand-new insurance coverage (Level term life insurance policy). Various companies offer different choices for conversion, be certain to understand your selections before taking this step

Consulting with a financial expert likewise might aid you identify the path that lines up best with your total technique. The majority of term life insurance coverage is level term for the duration of the agreement duration, yet not all. Some term insurance coverage might include a costs that increases with time. With reducing term life insurance policy, your fatality advantage drops in time (this kind is frequently gotten to especially cover a long-lasting debt you're paying off).

And if you're established for eco-friendly term life, then your costs likely will go up every year. If you're discovering term life insurance policy and desire to make sure straightforward and foreseeable monetary security for your household, degree term might be something to think about. As with any type of insurance coverage, it may have some constraints that don't satisfy your needs.

Discover What Term Life Insurance With Accelerated Death Benefit Is

Commonly, term life insurance policy is a lot more economical than long-term protection, so it's an affordable means to secure financial defense. Versatility. At the end of your contract's term, you have multiple choices to proceed or carry on from insurance coverage, commonly without requiring a medical examination. If your spending plan or protection needs adjustment, survivor benefit can be lowered in time and result in a lower costs.

As with various other kinds of term life insurance coverage, when the contract finishes, you'll likely pay greater premiums for insurance coverage because it will recalculate at your existing age and health. If your monetary circumstance modifications, you may not have the required protection and could have to purchase extra insurance policy.

Yet that doesn't imply it's a suitable for every person (10-year level term life insurance). As you're buying life insurance coverage, below are a few vital elements to consider: Budget plan. Among the advantages of degree term coverage is you know the expense and the survivor benefit upfront, making it simpler to without bothering with rises with time

Age and health. Generally, with life insurance policy, the healthier and more youthful you are, the even more budget-friendly the coverage. If you're young and healthy, it might be an attractive option to secure in reduced costs now. Financial responsibility. Your dependents and economic responsibility play a role in identifying your protection. If you have a young household, for circumstances, degree term can help give economic assistance during crucial years without spending for protection longer than essential.

Latest Posts

Is Burial Insurance The Same As Life Insurance

Company Funeral Policy

Insurance To Cover Burial Expenses