All Categories

Featured

Table of Contents

If you select level term life insurance policy, you can allocate your premiums due to the fact that they'll remain the same throughout your term. And also, you'll understand exactly how much of a death benefit your recipients will get if you pass away, as this quantity will not change either. The rates for level term life insurance policy will depend on several factors, like your age, health standing, and the insurance firm you choose.

Once you go with the application and clinical exam, the life insurance company will certainly evaluate your application. Upon approval, you can pay your first costs and authorize any relevant paperwork to guarantee you're covered.

Aflac's term life insurance policy is practical. You can select a 10, 20, or three decades term and enjoy the included assurance you are worthy of. Collaborating with an agent can help you find a policy that functions best for your needs. Find out more and get a quote today!.

As you look for means to secure your monetary future, you've most likely found a variety of life insurance policy choices. level premium term life insurance policies. Picking the best protection is a huge choice. You wish to discover something that will aid support your liked ones or the reasons vital to you if something occurs to you

Lots of people lean towards term life insurance policy for its simplicity and cost-effectiveness. Term insurance contracts are for a fairly short, defined period of time however have options you can tailor to your needs. Certain advantage alternatives can make your premiums transform over time. Level term insurance policy, nevertheless, is a kind of term life insurance policy that has regular settlements and a constant.

Preferred Term Life Insurance With Accelerated Death Benefit

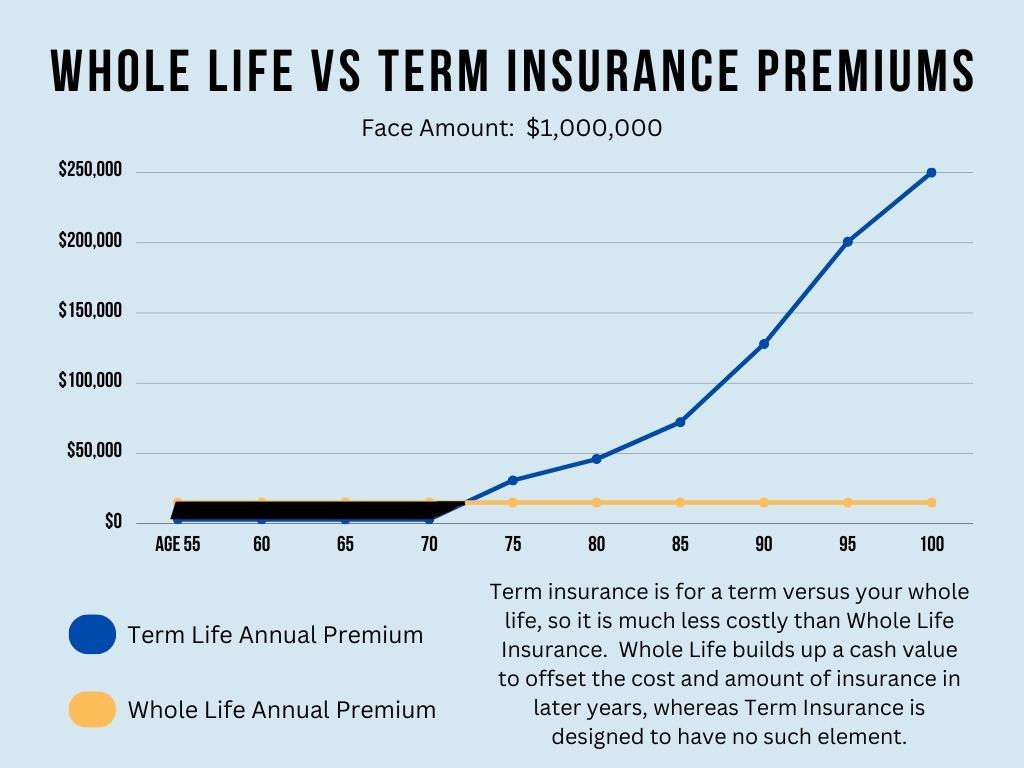

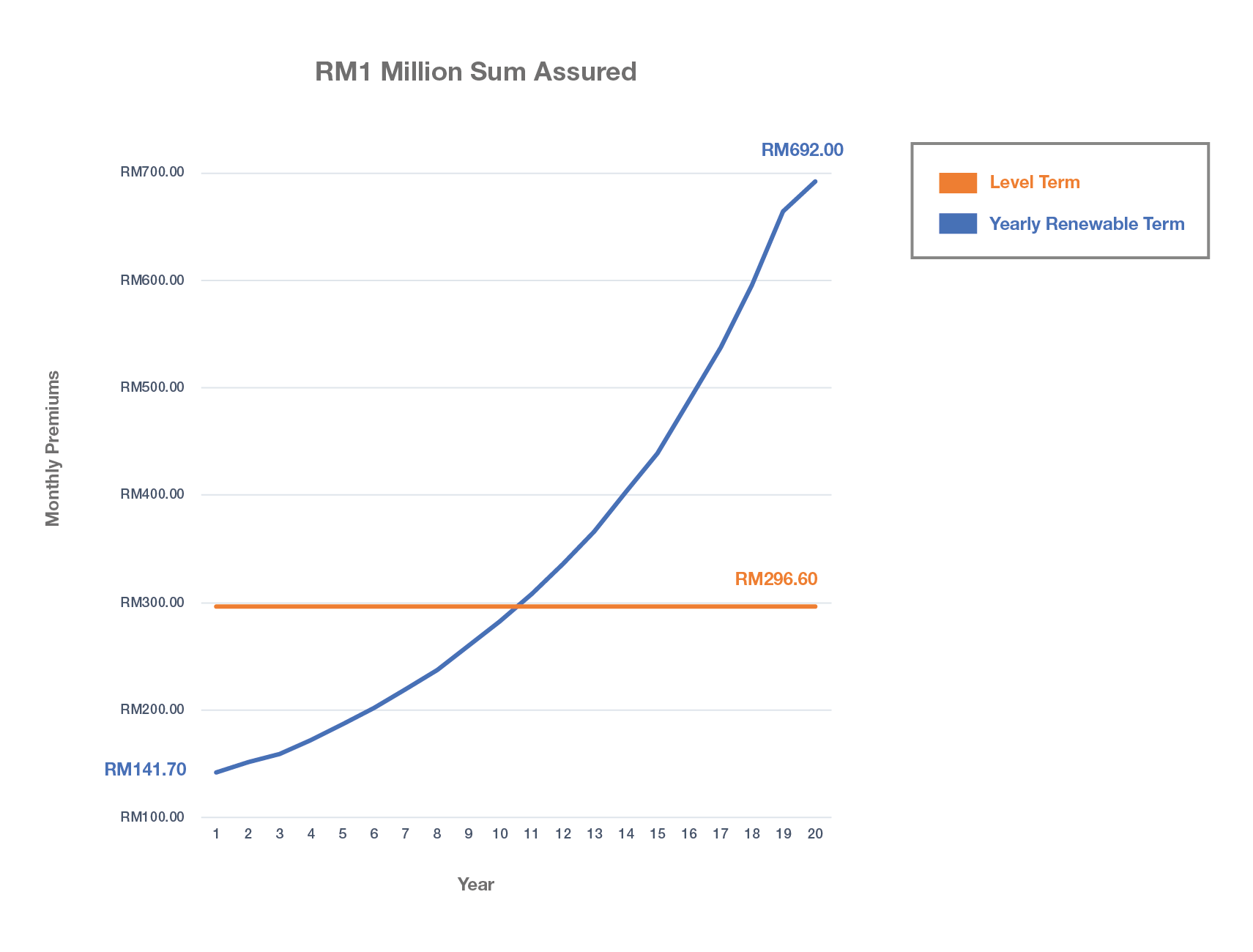

Degree term life insurance policy is a subset of It's called "level" since your costs and the advantage to be paid to your liked ones remain the exact same throughout the agreement. You will not see any type of changes in cost or be left asking yourself concerning its worth. Some contracts, such as annually renewable term, might be structured with costs that boost over time as the insured ages.

Fixed fatality advantage. This is likewise set at the beginning, so you can recognize specifically what fatality advantage amount your can anticipate when you die, as long as you're covered and updated on costs.

You concur to a set premium and fatality advantage for the period of the term. If you pass away while covered, your fatality advantage will be paid out to enjoyed ones (as long as your costs are up to date).

You may have the option to for one more term or, most likely, renew it year to year. If your contract has actually an assured renewability condition, you may not need to have a brand-new medical examination to maintain your coverage going. Nonetheless, your costs are likely to enhance because they'll be based on your age at renewal time (voluntary term life insurance).

With this alternative, you can that will last the rest of your life. In this situation, once more, you might not require to have any type of new medical tests, yet premiums likely will climb as a result of your age and brand-new insurance coverage. term life insurance with accelerated death benefit. Various business use numerous options for conversion, make sure to comprehend your options prior to taking this step

Increasing Term Life Insurance

The majority of term life insurance policy is level term for the duration of the agreement duration, yet not all. With reducing term life insurance, your death advantage goes down over time (this kind is typically taken out to specifically cover a lasting financial debt you're paying off).

And if you're established for renewable term life, then your premium likely will rise each year. If you're exploring term life insurance policy and wish to make certain straightforward and predictable economic defense for your family members, level term may be something to consider. As with any kind of type of insurance coverage, it might have some limitations that don't satisfy your needs.

Dependable A Term Life Insurance Policy Matures

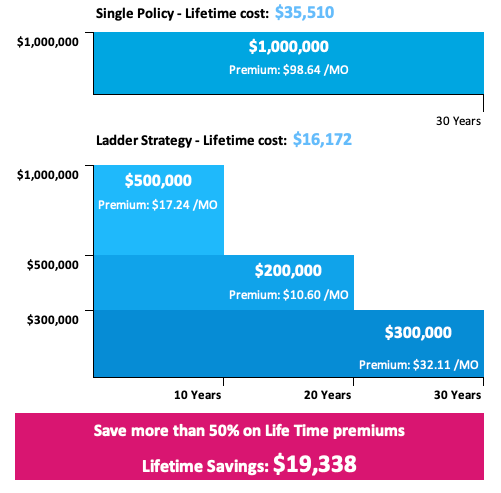

Typically, term life insurance policy is more inexpensive than long-term insurance coverage, so it's a cost-efficient way to protect economic defense. Adaptability. At the end of your agreement's term, you have several alternatives to proceed or move on from coverage, usually without needing a clinical exam. If your spending plan or protection requires adjustment, death benefits can be lowered with time and lead to a reduced costs.

Similar to other kinds of term life insurance policy, when the agreement ends, you'll likely pay higher premiums for protection due to the fact that it will certainly recalculate at your present age and wellness. Dealt with coverage. Level term uses predictability. If your financial situation modifications, you may not have the necessary coverage and could have to buy added insurance coverage.

That does not imply it's a fit for everybody. As you're purchasing life insurance, right here are a few key variables to take into consideration: Budget. Among the advantages of level term insurance coverage is you recognize the expense and the fatality benefit upfront, making it much easier to without bothering with boosts over time.

Age and health. Usually, with life insurance, the much healthier and more youthful you are, the much more economical the insurance coverage. If you're young and healthy and balanced, it may be an enticing alternative to lock in reduced costs currently. Financial obligation. Your dependents and financial responsibility contribute in identifying your insurance coverage. If you have a young household, as an example, degree term can aid give financial backing throughout critical years without spending for coverage much longer than necessary.

1 All motorcyclists go through the terms of the cyclist. All motorcyclists might not be available in all territories. Some states may differ the conditions (joint term life insurance). There might be a service charge related to obtaining certain motorcyclists. Some riders might not be readily available in combination with other cyclists and/or plan attributes.

2 A conversion debt is not readily available for TermOne policies. 3 See Term Conversions section of the Term Collection 160 Item Overview for exactly how the term conversion debt is figured out. A conversion credit score is not offered if costs or fees for the brand-new policy will certainly be waived under the terms of a biker providing impairment waiver benefits.

Outstanding What Is Level Term Life Insurance

Term Series items are released by Equitable Financial Life Insurance Policy Business (Equitable Financial) (NY, NY) and are co-distributed by Equitable Network, LLC (Equitable Network Insurance Policy Firm of The Golden State, LLC in CA; Equitable Network Insurance Firm of Utah in UT; and Equitable Network of Puerto Rico, Inc. Term Life Insurance is a type of life insurance policy that covers the insurance policy holder for a details quantity of time, which is understood as the term. Terms normally range from 10 to 30 years and rise in 5-year increments, supplying level term insurance coverage.

Latest Posts

Is Burial Insurance The Same As Life Insurance

Company Funeral Policy

Insurance To Cover Burial Expenses